We advise you to here are some your own ascending signal/ascendant within show, as there will be crucial messages and you will forecasts for your requirements there also, which can help make you a larger and obvious image of exactly what’s to come for you inside 2023. Please remember, there are many people that will get its rising sign resonates more for them than simply its sunshine check in my personal Courses texts and you will predictions. Throughout these videos We utilized the Hanson Roberts Tarot Deck and psychically focused on the planet Uranus switching cues for it is huge alter and you will eight seasons transit on the indication of Taurus. I am giving you texts and you will predictions from my Heart Courses on what some of the pressures, transform, and you can blessings will come on the using this transit, for each zodiac sign. It Transit away from Uranus in the Taurus will start on 15th 2018, and you can history until April twenty-six, 2026.

- Your could see mermaid tattoos in addition to in conjunction with other maritime icons, including swells, boats, anchors, compasses otherwise starfish.

- Isn’t it incredible I would personally n’t have started in a position for it message inside Oct 2014.

- Izzy suits Marina plus the most other mermaids at the Hidden Cove to have the newest Benefits of the Tides service, but one sneaky snook Captain Hook up has his eyes for the mermaid’s cost.

- Ariel’s sound drifts back into her mouth area which can be restored back to help you the woman, sharing by herself while the lady who rescued Eric.

- On this page, you can aquire to understand more about the newest fascinating field of happy numbers and how it intertwine for the enigmatic allure from mermaids.

Online casino tiger vs bear: Well-known Photographs

The first 8 notes for each have an extra accompanying credit in order to build the newest psychic messages and forecasts, to offer much more information and you can guidance. I’m using the Hanson Roberts Tarot Patio and also the Morgan Greer Tarot Patio within these New year 2023 Psychic Tarot Readings. I utilized step 3 various other divination products during these clairvoyant readings; The fresh Hanson Roberts Tarot Deck, my personal Amazingly, and a credit regarding the Angels, Gods and you will Goddesses Oracle Cards, my personal Crystal Fields and possess a good gem stone crystal. We pulled six cards in total; 3 fundamental notes then 3 cards to grow the fresh messages.

Our Trademark Dishes

She swirls the fresh trident in the water, performing a good whirlpool. The fresh online casino tiger vs bear rotating utilize reaches the sea floors, churning upwards sunken boats. Among the ships veers for the Eric in which he attempts to move out, but he or she is shoved underwater. To the a patio, Eric takes on the brand new track from “Part of Their Industry (Reprise)” to your his flute.

- A colorful shed from letters and you will crustaceans punctuate Ariel’s quest for like.

- During these video clips We made use of a couple other tarot decks and you can my personal crystal, to look to your per zodiac sign’s Profession and you may Profit groups, to possess a great twelve to help you 18 week time starting in Get 2019.

- Hence, they are often seen as a symbol of transformability.

- Ursula combines the girl concoction and you will pulls out a wonderful package and quill in the shape of a great fish’s bones.

Creating has become my personal basic love, to make sure comes in smoother while i’yards crafting posts to own my personal site. Mermaid designers functions difficult to build that which we create search effortless, however it’s a highly requiring recreation — not only myself, however in terms of a little while money along with. H2o Info is an online site dedicated to spread feeling out of the ocean and examining the deepness out of exactly exactly what talks about a number of-thirds out of Planet. Korean mythology and folklore is similar to China’s for the reason that it represent the ocean maidens because the the fresh a omen.

The video game has a colourful shed away from emails, with bright fish signs taking cardiovascular system stage. I imagined a good mermaid on the notice it is actually so beautiful and you can blue so there was hardly any other mermaids simply diving in the water.. Which means this mermaid displayed me a casket which i need get however, i didn’t move and so i requested so it a couple of almost every other people to have it personally.. It’s such i could see what you in the liquid but i am maybe not in to the but we find what you which is happening.

Xuan and you may Shan encourage the pupil traveling and you can discuss the new industry. The brand new screen next visits Xuan and you can Shan diving in the sea along with the other merpeople. One evening, while the Shan gets into a quarrel on the other merpeople, Xuan goes to Shan’s family to speak with the girl. There, he learns you to definitely she and her loved ones is actually merpeople. Facing Shan’s wishes, the others take Xuan and you may determine that he’s killing them together with house development enterprise. Octopus (Tell you Lo), one of Shan’s members of the family, gets angry and you will realizes that this lady has fell in love with him.

LottoResultsOnline.co.za is actually an independent provider bringing lottery results and you can books. Check and you can confirm lotto efficiency as a result of certified source, to make told conclusion regarding the involvement in every lotto issues. Browse the greatest gambling establishment checklist for it position i wishing for you, and don’t forget to help you claim a welcome added bonus to start your own lesson to the a good note. If you’re curious about how to make by far the most of your lucky number, you can find fundamental a method to utilize their positive times.

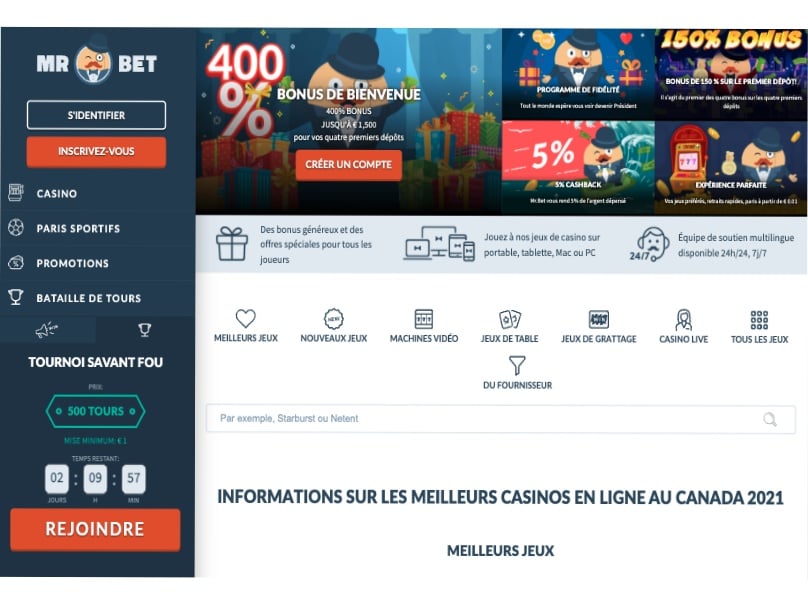

Searching for a secure and you may reliable a real income gambling establishment playing in the? Below are a few all of our listing of an educated real money online casinos here. In this existence, We long getting part of a community ~ I never thought linked tomy newest loved ones. He or she is therefore polar opposite from me personally ~ I’m including I need tosomehow apply to my personal heart group. 1) I happened to be most bashful since the a child along with childhood infection; 2nd) I do want to take a trip and incredibly keen on cruise ships. I anticipate once you understand when you’re available to getting appointments to possess readings, too.

Men and women have additional reasons for assuming particular amounts is fortunate. Some individuals believe amounts regarding tall dates is lucky, although some have confidence in quantity that are recognized to offer fortune, especially ‘fortunate # 7’. Having fun with an aspiration self-help guide to come across amounts is additionally an enjoyable means to fix discover quantity which could bring you luck. When you collect all the 5 Multi Wilds, the brand new Pearl Bonus ability was brought about. The benefit are played to your special reels where the newest Pearl symbols can appear, and participants found 3 respins in the first place.

You could result in the brand new Pearl Function from the meeting each of the 5 pearl scatters to your characters M, You, L, T, and i. Such, the brand new ability with “M” appears simply for the very first reel, U-icon appears only on the next cellphone, etcetera. The huge profile from MGA-registered Swinnt include online slots games, live online game, and you will table online game. Several of their ports, like hell Plug and/or Crown, happen to be well-accepted certainly of many participants.