Articles

VIP bar professionals right here will love constant and you will exclusive gambling enterprise incentive offers, in addition to their own video game whilst flipping things on the honours. Such, for many who deposit through particular elizabeth-wallets you may not be eligible for a deposit incentive, and several campaigns commonly accessible to players regarding the Uk. If you feel you’re permitted an advantage but you sanctuary’t obtained they, contact the customer service agencies in the gambling enterprise. Our accepted casinos have extensive game choices in the leading app company, as well as fair transactions and you will game play, and excellent customer support. As well, those people lucky enough to win playing that have bonus money have smaller chance of indeed viewing those payouts as the cash.

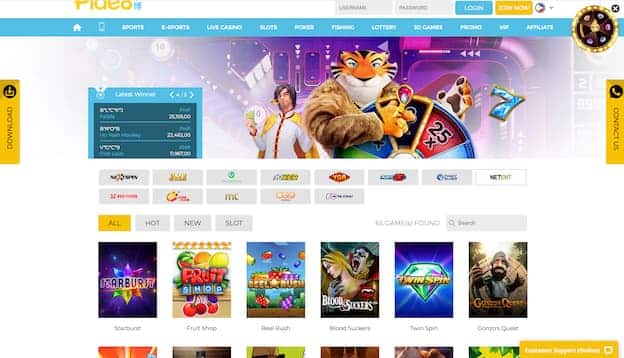

Pop over to the web-site: Why does the uk Betting Percentage assistance with casinos providing zero betting bonus?

You do not want as handing over their hard-attained dollars in order to an unidentified alternative party – your don’t determine if it does ever reach its destination! The fresh gambling enterprise web sites pop over to the web-site need a summary of the new payment company that they fool around with in the really bottom of its head page. We discuss per web site and defense support service very our very own people know and that Uk gambling enterprise websites are worth the day. Put simply, i make sure to look at the tech support team’s effect time and each of the areas of the new FAQ page. Immediately after an online site seats all of our examination it produces a location on the all of our listing of advised casinos. Participants should know one to to have crossbreed now offers, giving each other in initial deposit bonus and free revolves, that every can get a new wagering requirements, very take a look at T&Cs for additional info.

Secret Earn

You should use gambling establishment bonuses to generate income, and if you meet up with the wagering conditions (or no), you can withdraw your bank account. But not, bonuses is highly recommended an enhance to the bankroll and not be used forever. A gambling establishment incentive is awarded in order to professionals by casino, when you are real money is transferred by the athlete. Local casino bonuses might have restrictions to the incorporate and you may distributions, if you are a real income doesn’t. The Instructional Middle is a wonderful money for new participants just who want a betting guide for a much deeper comprehension of casino extra now offers. If you would like allege a bonus at the an alternative gambling establishment, mention the fresh in depth casino guides appeared within our Academic Center to help you discover ways to benefit from the bonuses as the to play sensibly.

Discover Casino Bonus Betting Standards

- Ongoing promotions are worth contrasting too, as numerous web based casinos give each week if not every day treatment of free spins to play that have.

- Still, we usually strongly recommend using PayPal no matter where readily available as a result of the highest amount of protection the fresh put approach offers.

- The databases try current each day so that you will not have so it state in the event the having fun with our very own webpages while the information.

- The subscription might possibly be approved rather than exclusion, regardless of whether you’ve got thinking-excluded from other websites.

- British Gambling establishment Pub also provides in initial deposit gambling establishment extra that have a regard of 100% as much as €one hundred.

- Wagering conditions will vary anywhere between all of the a real income online casinos, and even of added bonus to help you added bonus within an individual local casino.

We are in need of you to gamble on top casinos and have a premium-top solution. To achieve that, we review all the the new casinos popping up in britain’s Websites stratosphere. As well as conventional advertisements, there may even be possibilities to safer a share away from a great honor pond in the competitions, if you don’t earn a vacation or something like that of these character.

Make sure you meticulously review the brand new local casino’s web site before transferring one finance, since the deposit and you can detachment constraints can differ based on the selected fee method. The brand new invited incentive, the first tempting give viewed by beginners, is usually the biggest to draw inside the the fresh participants. Exclusive in order to the fresh accounts, which incentive kicks inside the after you’ve entered making their initial deposit. Inside the non-GamStop casinos, position video game, such jackpot slots, rule ultimate as the crowd favourites. This type of online game rely available on luck and brag a comprehensive assortment out of templates, anywhere between smash hit video clips in order to diverse sporting events, historic occurrences, and you may unique venues. Established in 2001, the brand new Malta Gambling Expert (MGA) really stands since the a well known regulatory entity inside the Europe, overseeing gambling on line issues.

You need to understand you to a zero-put bonus is a tool of several web based casinos use to desire the new participants and not a source of earnings. Sure, clearing wagering and you will launching cashout can be done, nevertheless limit cashout usually can getting £50. It’s a type of extra, or, inside the simple conditions, a marketing means to fix welcome the fresh participants giving her or him difficulty-free entry to gambling games. You will need to understand that, with a few exceptions, most gambling establishment incentives is subject to wagering requirements.

Should you deal with waits otherwise items, examining the new ‘Deal record’ lower than ‘Withdrawal’ on the cashier part might provide information. All the withdrawals read a review of as much as two days ahead of processing. Getting the account totally verified to possess quicker access to payouts is also let automate this action.

Flick through the brand new listings to your our web site to see a gambling establishment giving a no-deposit extra you to captures their attention. It’s better to verify that the newest no deposit added bonus render remains energetic. Register during the Chance Casino and found around one hundred Totally free Revolves and no deposit required, readily available for fool around with on the common slot video game, Legacy out of Deceased.

Professionals get shoulder any of these will set you back thanks to smaller incentives, down chance or other money-protecting actions. The new gaming industry is moving ever before-send, and you will 2023’s set-to become an awesome year with additional games, invention and you may the newest casinos than before. However,, due to Brexit, changes is additionally floating around also it’s value spending an additional to think about just what’s taking place on the globe. Receive very first put render from 30 totally free revolves for the Double Bubble or 50 totally free bingo tickets after you put and choice £10 at the Jackpotjoy. Faerie Means from the Betsoft ensure it is a plus pick selection for 86x the leading to share.

A 3 hundred% gambling enterprise bonus try a publicity from the an online gambling enterprise that matches their put matter by the 300%. This may leave you additional money to try out having, have a tendency to associated with certain conditions and terms, even though. The professionals, that have several years of expertise in casinos on the internet and bonuses, read all gambling enterprise as well as their provide. By simply following all of our score guidance it view if your incentive is definitely worth getting at the top in our directories or at the end. No matter their gambling wishes, Ladbrokes is preparing to look after all sorts of pro pages.

Particular gambling enterprises get demand limits on the certain game, including real time gambling establishment. It is very important keep in mind that there isn’t any single local casino extra that fits individuals. Regarding choosing a extra, bear in mind the playing build, what type of game you desire and exactly how far you imagine you could put during the local casino. A free of charge spins bonus provides you with a set amount of revolves on the a specified position online game or game. Here is the primary treatment for try out another games instead betting their real cash straight away. Suggestion bonuses is awarded to professionals which establish someone else so you can an on-line casino and that individual continues on to help make a casino membership.

So it aesthetically beautiful games has the unique Avalanche Reels and contains medium so you can large volatility. The true magic lies in the 100 percent free revolves rounds making use of their unique multipliers. Starburst try a minimal volatility slot out of NetEnt brought inside the 2012, and it has getting a vintage in the world of on line playing. And it is not only on the birthday that you could claim totally free spins.

Fits deposit incentives try the newest online casino bonuses one to reflect participants’ deposits. If you put, the new gambling enterprise matches your own put as much as a flat restrict. They may be part of a welcome extra, but a pleasant extra isn’t necessarily a fit deposit bonus. The best thing about applying to an on-line casino website gets a player incentive. Great britain has many of the finest gambling enterprise added bonus also provides, and we makes it possible to discover perfect one. When you deposit that have PayPal during the casinos on the internet, you are eligible for private bonuses tailored for PayPal users.

I do believe it’s day i point of showy sale and become a lot more transparent and you may reasonable. With that being said, I’m able to manage my outmost to teach participants so they may take complete benefit of these incentives. When you enjoy at the subscribed casinos which have PayPal, all of the online game pay real money. Authorized web sites is independently audited to ensure their game aren’t fixed and provide you with a reasonable chance of profitable. Thus, you might enjoy in the live gambling enterprises which have PayPal put, PayPal harbors sites, or other form of United kingdom-registered PayPal playing website and victory real money.