Blogs

Incentives and offers are a primary mark for Minnesota professionals, that have online casinos providing individuals enticing bonuses to draw and you may retain her or him. The newest gambling establishment also provides a variety of book inspired games, in addition to slot video game having enjoyable under water templates one transportation you to definitely additional realms away from online deuces wild 100 hand sign up bonus excitement. As well, they supply specialization video game such bingo, keno, abrasion cards, and you can lottery, ensuring a diverse betting feel to own players inside the Pennsylvania. Incentives and you may offers try a major emphasize of your own PA on line local casino world, offering tempting rewards and you will bonuses to people. Of deposit fits and you will free revolves to cashback now offers, this type of bonuses can be somewhat boost your gaming experience and enhance your possible earnings.

Whether your’re a top roller or a laid-back player, effective bankroll administration can raise the gaming experience. Remember, objective would be to appreciate the online game, not to ever recoup your own losses. If or not your’re a seasoned user otherwise a novice to everyone away from on the internet gambling, selecting the right casino produces a big difference. Bear in mind the tips common within book, therefore’re also certain to find a different online casino you to’s good for you. Selecting the right online casino is a choice one to is deserving of mindful consideration.

Support perks within the web based casinos try things redeemable for cash otherwise awards based on wagering membership. Normal participants can also be accumulate issues as a result of the betting issues, boosting the overall gaming feel. Real time specialist games inside the Minnesota web based casinos help professionals relate with real traders, performing an enthusiastic immersive playing sense at home. Getting real buyers enhances the adventure and you will public element of the overall game, attractive to real-time playing enthusiasts. Thunderpick are an internet gambling enterprise known for its number of betting choices and you may an effective focus on esports gambling.

Financial & fee actions: online deuces wild 100 hand sign up bonus

I tested a lot of websites, and from our professional experience, we can tell you to defense is the most essential foundation in order to meet the requirements when to play gambling games on line. To put it differently, your give sensitive and painful private and you can financial advice when making a free account. Among the top ten United kingdom casino internet sites, NetBet works with one another pc and you can mobile phones. Along with, once a registration, you could allege a pleasant plan all the way to five-hundred incentive revolves because the a primary-day user, and also have entry to the new highest-high quality customer service NetBet provides.

This way, you can be certain your casino are legit and you will allows you to register properly. 100 percent free elite group instructional programs for on-line casino team intended for community guidelines, boosting pro sense, and fair approach to gaming. First, you ought to choose a reputable on-line casino, so that your winnings is paid for your requirements for many who perform winnings. Next, you have to know you are always to play at a disadvantage inside the an internet gambling establishment. Therefore, you might victory and possess the winnings given out, but it is more likely that you’ll remove.

A whole lot of Jackpot Possibilities

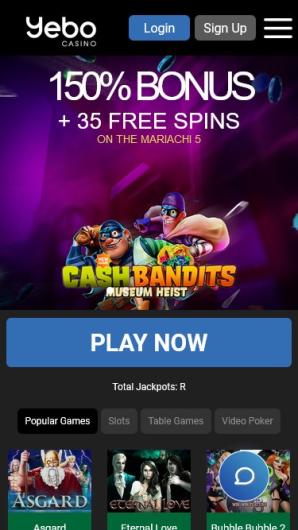

Additional aspect of the sale standpoint is you usually not the only one who’s aware of it. When they are stocked with fair terms and conditions, an excellent wagering requirements, and you can most importantly, value, they are able to extend your own money and provide you with far more opportunities to victory. You need to use which bonus deal to create their bankroll, giving you more revolves and chances to earn.

The way we Examine The On-line casino Web sites

When it comes time about how to consult a profit out for the payouts, the procedure is rather effortless. Indeed, of several professionals view it easier than just and make a deposit in the first place while the there is certainly often reduced information to put in. However, here is a simple notion of what you will end up thinking about whenever the period will come as much as.

By the getting a variety of representative analysis, community professional ratings, and you will gambling enterprise provides, we provide you with everything you need to get the best web site to you personally. Respect advantages need to be considered because you play with an internet gambling establishment for a long period. Of numerous internet sites render participants respect items and you may allow them to exchange him or her for cash, incentives, or other perks. When the indeed there’s a good VIP club, it’s in addition to this, as you’re able boost your height and you can open a lot more personal benefits. Larger Twist Gambling enterprise has been around since 2017, which has the feel you’ll predict from a premier playing web site.

For devoted players, there are slot leaderboard competitions that have large prizes available and you will a loyal support program. For the cellular front, the fresh user’s programs pack a slap, rating cuatro.8 on the Software Store and cuatro.six for the Yahoo Play Shop. Because you navigate the overall game reception, it’s not hard to notice the ‘Exclusive’ group. This type of online game try unique to help you DraftKings and have the signature advertising. Good morning Many is considered the most all of our most recent sweepstakes gambling enterprises, featuring a robust invited give, and plently of novel company.