You will always find a very good no deposit incentives while the lingering offers to own existing players https://happy-gambler.com/great-blue/rtp/ , even though they are now and again element of a welcome plan. Think about, only a few video game out of an online gambling enterprise would be available on the new cellular gambling enterprise. This is an essential thought whenever choosing if you can engage within the a plus from your own smart phone. While this looks like a primary limit, the truth is 90% (or higher) out of online casino games run using mobile.

Get the best mobile local casino bonuses

A knowledgeable casinos help many banking methods for places, withdrawals, and you will commission rapidly. I think all commission procedures offered during the an online local casino before you make our very own information. Whatever you like any concerning the software is that the sportsbook and you can gambling establishment is actually merged, permitting instantaneous altering ranging from sports betting and casino betting.

How to Set up Gambling establishment Programs on your Cellular telephone otherwise Pill

You’ll must also features fulfilled this site’s playthrough conditions for many who accepted a pleasant bonus. Should it be playing cards, e-purses, or bank transfers, i have your secure.

Difference in Cellular Gambling enterprise and Casino Applications

For the best feel, make sure to’lso are for the cellular type of your website. Another blacklisted internet sites show again and again you to definitely they could’t be respected. Prior to claiming people added bonus, cautiously read and see the small print.

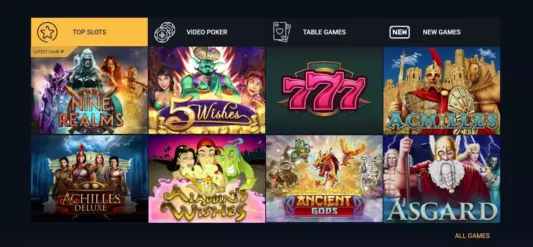

Hopefully, we’ve revealed you how within the mobile gambling enterprise globe. If you want safe and reputable choices, choose one of the cellular gambling enterprises from our page. Whenever comparing the best mobile gaming hubs for us people, first thing i look into ‘s the depth plus the set of this site’s games profile.

FanDuel Gambling establishment — Better You.S. casino application

Whether you are a fruit aficionado or you like the broad assortment of Androids available to choose from, each other programs give an efficient gateway for the mobile playing globe. Whenever delving to the cellular casinos, one of the crucial choices spins to choosing anywhere between ios and you may Android programs. Whether you’re looking an android os local casino otherwise a new iphone gambling enterprise, keep in mind that for each has its own number of pros and you can considerations. The brand new classic card video game of Black-jack provides receive a different household inside the cellular gambling enterprises. Slots rule best in the wide world of mobile gambling enterprises, providing layouts anywhere between nightmare to fairytales.

To determine which casinos are the most effective, i play with all of our Covers BetSmart Rating, and this takes into account the trick aspects of a gambling establishment’s providing. Indication for the app on the log in history you composed during the the fresh account registration processes. The contrary is always to play within the web browser to your html5 mobile type of the brand new casino web site. Nabers prospects the fresh Creatures inside receptions that have thirty five and you may m finding which have 386 from earliest four video game. Nico Collins of the Houston Texans (10.8) is the only almost every other person from the NFL averaging double-thumb targets for every games. Check if you’ve got a web connection by visiting other websites or carrying out a google lookup.