Why does an effective 401(k) mortgage really works?

To be acknowledged for a financial loan out of your 401(k), you’ll want to realize numerous guidelines. Not totally all 401(k) preparations allow you to obtain out of your account, so be sure to talk to the firm handling their financing earliest. Some tips about what you must know:

- Financing wide variety: You can either obtain $fifty,000 otherwise half of brand new vested balance – whatever was reduced. However, if the 50% of account balance is actually smaller than $10,000, the new debtor may take away up to $ten,000.

- Financing terms: Typically, you really have five years to repay good 401(k) loan. An exclusion compared to that, yet not, is utilizing your own 401(k) to fund a property .

- Spousal recognition: It is far from unusual both for partners is in it if it relates to spousal financial obligation , and you can 401(k) financing are not any different. Your wife must give authored consent if you plan to take out an excellent 401(k) financing more than $5,000.

- Taxation effects: If you fail to match payments, your loan was noticed a shipping, and that is taxable. This can trigger a big costs when you document their taxation .

401(k) mortgage versus. 401(k) withdrawal

Taking out a loan is not the only way you can access the cash on your 401(k) account. You may make a great 401(k) withdrawal, including a difficulty withdrawal. The brand new Irs specifies you to an adversity delivery is only able to be studied to your a keen immediate and you can heavier financial you want and may end up being restricted to a necessary amount, if not it’s nonexempt.

While you’re not necessary to settle an excellent 401(k) detachment, how money can be utilized in terms of adversity distribution is bound. Here you will find the implies you might be permitted to make use of 401(k) hardship detachment funds:

Advantages and disadvantages regarding 401(k) finance

If you don’t have a crisis money otherwise has an adverse credit score , you will be considering a great 401(k) loan. Yet not, you will find several risks so you’re able to taking out fully good 401(k) financing.

For those who hop out your task, you may have to pay back the loan quickly otherwise within a short screen of your time

How does a good 401(k) loan functions for many who change jobs?

By using aside a great 401(k) mortgage and you may switch jobs , you might be getting yourself within the a tight financial position. Very 401(k) arrangements need you to immediately pay off the brand new delinquent harmony in full. Specific companies provide a preliminary grace months.

Or even repay your 401(k) loan till the deadline, the remainder money in your 401(k) could be grabbed in what’s known as that loan counterbalance, which wipes out your leftover personal debt. Because the financing offsets are believed nonexempt, you’ll have to spend an income tax on number and you will a beneficial 10% early shipping punishment. In the event the the new 401(k) workplace account accepts rollovers, your loan counterbalance would be went towards the one to brand new package and that helps you avoid the income tax implications.

Selection so you can credit regarding a beneficial 401(k)

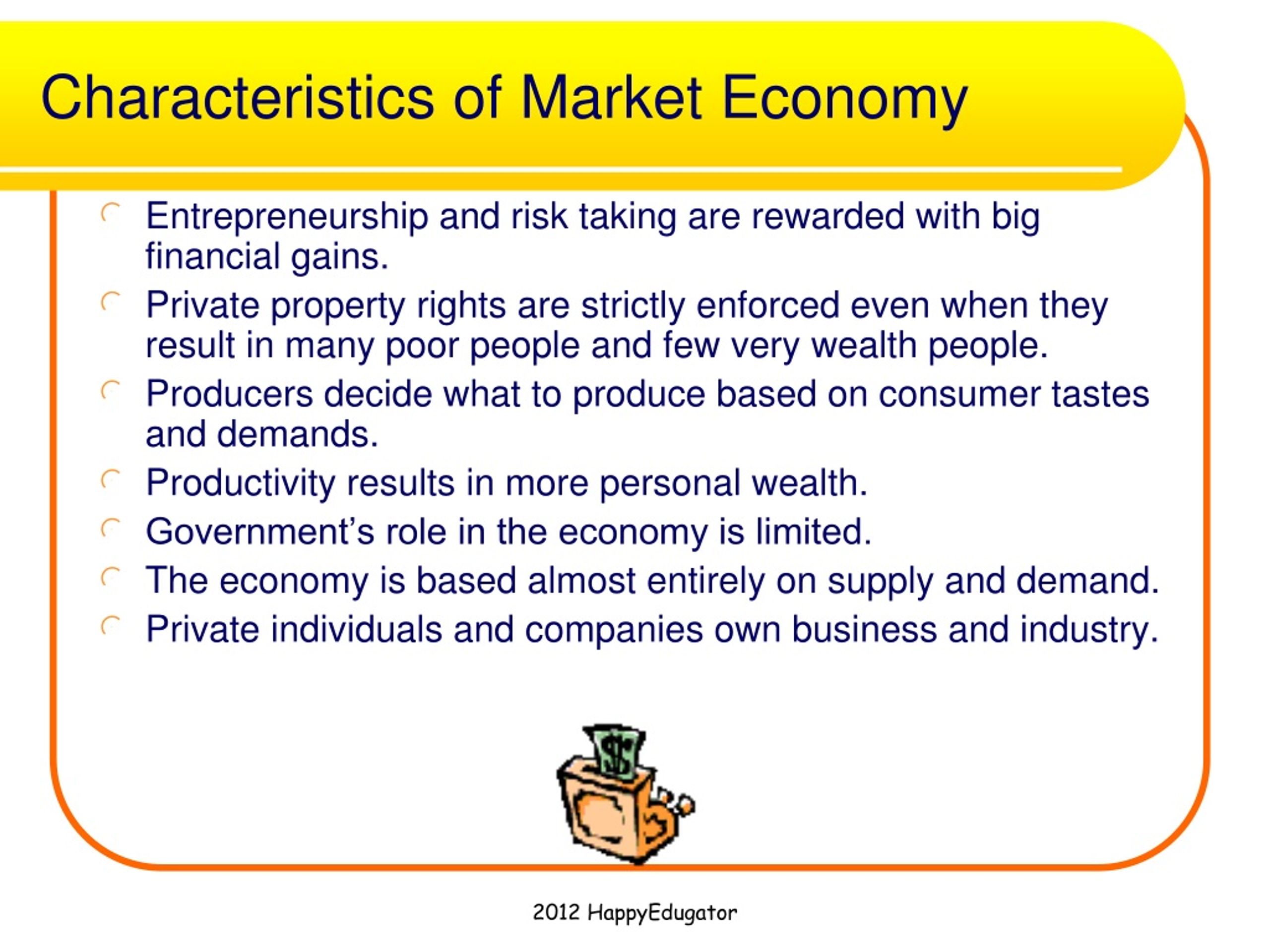

The expense of an effective 401(k) financing can add up. Furthermore, rescuing for later years is actually a lengthy-identity objective that will be upended by the a preliminary-term condition if you borrow secured on they. If you’re not safe delivering money out of your old age package, evaluate these other choices:

- Use your health savings account (HSA). If for example the reason you need a great 401(k) loan has to do with medical costs, coverage those individuals will cost you with your HSA for those who have that. These package is a kind of family savings that allows you to contribute money from your paychecks – untaxed – to fund specific scientific expenses.

- Withdraw from your own disaster financing. Your come their disaster financing having just it objective: to fund unforeseen expense and get away from trying out obligations. Making use of your crisis loans in place of borrowing away from a beneficial 401(k) could save you cash on attention, punishment and you can fees.

- Get a reduced-interest credit card. Certain financial institutions bring 0% intro Annual percentage rate handmade cards to licensed consumers. These handmade cards will let you end paying rates of interest to possess a basic period, that be as durable because 21 weeks in many cases. Be sure to pay-off the latest cards before 0% Apr screen closes or you will need to shell out desire into Victor loans leftover equilibrium.

- Utilize non-advancing years profile. Think dipping to your most other banking accounts just like your checking, deals and you may broker account. This process can help you prevent pricey costs and interest levels.

- Get a personal loan.Unsecured loans can be used for a variety of purposes, and level a huge bills. This one tends to be perfect for people with advanced borrowing from the bank because the signature loans are generally personal debt that will have highest interest levels if your credit is not powerful.